Introduction – The Hidden Financial Game of the Wealthy

The phrase “the rich get richer” has never been more accurate — or more misunderstood.

While the average person focuses on income, the wealthy focus on strategy. They play a different financial game entirely — one that isn’t about working harder but about using the tax code smarter.

The truth is shocking yet simple: the rich don’t pay fewer taxes because they cheat — they pay fewer taxes because they understand the system better. They know where to put money, how to classify income, and which assets grow tax-free.

In 2025, as global governments attempt to close loopholes and tighten financial regulations, the ultra-wealthy are already several steps ahead — using new digital strategies, offshore entities, and AI-powered financial tools to keep more of their wealth.

This article exposes the legal but elite world of tax loopholes, showing not just how billionaires protect their wealth — but how you can adapt the same principles to build your own.

How the Wealthy View Taxes Differently from Everyone Else

Taxes as Strategy, Not a Burden

The wealthy don’t view taxes as an obligation — they view them as a game of optimization. Every law, every deduction, every exemption is a piece of a puzzle. Their mindset isn’t “How much do I owe?” but rather, “How can I structure this to owe less — legally?”

A billionaire might earn $50 million a year but only pay taxes on $2 million — not because they’re dishonest, but because they know how to turn income into capital gains, borrow against assets, and shift profits across entities.

The “Keep More, Earn More” Mentality

While middle-income earners save after taxes, the wealthy save before taxes.

They set up corporations, trusts, and investment vehicles that allow income to flow through tax-efficient structures. Every decision — from buying a jet to donating to charity — is strategically linked to a tax benefit.

Why Financial Education Is the Greatest Advantage

Wealthy individuals invest heavily in tax education and advisors. They pay professionals who know every nuance of the 75,000+ page tax code. As Warren Buffett famously said,

“If you’re in the 1% of income earners, you should know 99% of the tax code.”

Most people never learn these principles because they’re taught how to earn a paycheck, not how to structure wealth.

The Legal Foundation Behind Tax Loopholes

Why Loopholes Exist (and Who They Benefit)

Contrary to public perception, loopholes aren’t mistakes — they’re intentional features of the tax system. Lawmakers design incentives to stimulate investment, create jobs, or encourage innovation. But these incentives disproportionately benefit those who already have capital.

For example, the capital gains tax rate (often 15–20%) is lower than income tax rates (up to 37%). Why? To encourage investment.

However, the people most capable of investing — the rich — reap the majority of these benefits.

Difference Between Tax Evasion and Tax Avoidance

It’s critical to note: tax evasion is illegal — hiding income, falsifying records, or underreporting.

Tax avoidance, however, is completely legal — it means structuring your finances to minimize liability within the law.

The ultra-wealthy master this art through complex but legitimate financial engineering.

How the Wealthy Use the System’s Rules to Their Advantage

Every major fortune — from Jeff Bezos to Elon Musk — leverages tax code nuances. Amazon famously paid $0 in federal income taxes in multiple years, despite earning billions.

How? Through reinvestment, depreciation, and stock-based compensation, all designed to minimize taxable income.

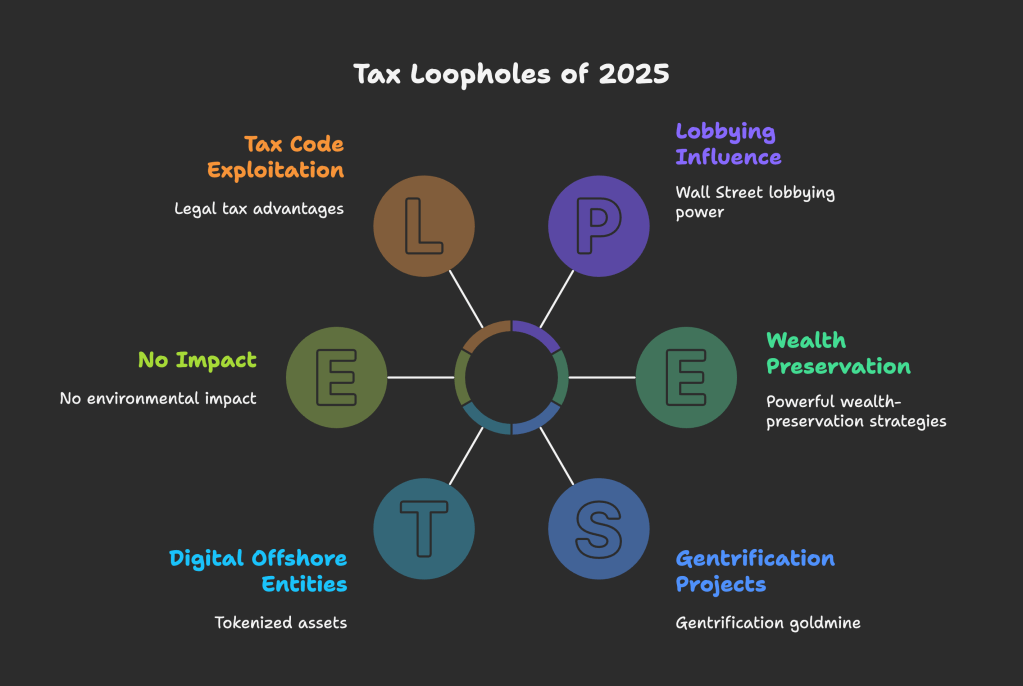

The 10 Most Powerful Tax Loopholes of 2025

1. The Step-Up in Basis Rule

When assets like stocks or real estate are inherited, they’re “stepped up” to current market value.

If your grandfather bought Apple stock for $1,000 that’s now worth $100,000, your tax basis resets at $100,000 when you inherit it.

That means if you sell it for $100,000 — you pay zero capital gains tax.

This single loophole allows trillions in intergenerational wealth to transfer tax-free every decade.

2. Real Estate Depreciation & 1031 Exchanges

Real estate is the crown jewel of tax advantages. Investors can deduct depreciation — a paper expense — against real cash income, often creating “losses” on paper while earning profit in reality.

Then, through a 1031 Exchange, they can sell property and reinvest the profit into another property — deferring capital gains indefinitely.

This is how real estate moguls like Grant Cardone and Donald Trump build vast empires while paying little in taxes.

3. Offshore Trusts and Tax Havens

Billionaires don’t just stash money in Swiss accounts anymore — they use trusts in places like the Cayman Islands, Singapore, and the British Virgin Islands.

These trusts hold ownership of assets, separating the individual from the wealth legally.

In 2025, digital offshore entities now include tokenized assets, where ownership is fractional, private, and tax-advantaged.

4. Borrowing Against Assets Instead of Selling

This is one of the most powerful wealth-preservation strategies ever.

The ultra-rich borrow against their stock or real estate portfolios instead of selling them.

Loans are not taxable events — meaning they can access millions, live lavishly, and still show zero taxable income.

Elon Musk, for instance, has used margin loans to fund lifestyle expenses while keeping Tesla shares intact — zero taxes owed.

5. The Carried Interest Loophole

One of the most controversial — yet persistent — advantages for the wealthy is the carried interest loophole. It allows hedge fund managers and private equity partners to pay capital gains tax (20%) on their earnings, rather than ordinary income tax (up to 37%).

Here’s how it works: when a fund manager invests on behalf of clients and earns profits, that income is treated as investment income, not salary. As a result, these managers pay nearly half the tax rate of high-income employees like doctors or engineers.

Despite years of political promises to close this loophole, it continues to thrive — largely due to Wall Street lobbying power and the argument that it “encourages investment.” In reality, it’s one of the clearest examples of tax privilege for the financial elite.

6. The Qualified Small Business Stock (QSBS) Exemption

For startup founders and angel investors, Section 1202 of the tax code is pure gold. It allows anyone who holds stock in a qualified small business (QSB) for over five years to exclude up to $10 million in capital gains from taxes when they sell.

In Silicon Valley, this exemption has turned countless startup millionaires into tax-free multimillionaires overnight. The original intent was to reward innovation and risk-taking, but now it’s an essential part of venture capital exit strategies.

For example, if a founder sells their startup for $50 million and qualifies under QSBS, the first $10 million is completely tax-free, and the rest may be deferred through smart reinvestment.

7. Opportunity Zones and the “Gentrification Goldmine”

Introduced in the 2017 Tax Cuts and Jobs Act, Opportunity Zones were designed to drive investment into struggling communities. Investors can roll capital gains from other assets into these designated areas and defer, reduce, or even eliminate taxes.

In theory, it’s a win-win: money flows into underdeveloped regions, and investors benefit from generous tax breaks.

However, in practice, many Opportunity Zones have become gentrification projects that primarily benefit developers, not local residents. For wealthy investors, it’s a powerful tool: reinvest capital gains, claim massive tax breaks, and still profit from appreciating urban real estate.

8. The Roth IRA Mega Backdoor

The Roth IRA was designed to help middle-class savers build tax-free retirement wealth. But the ultra-wealthy have discovered a way to supercharge it using the “Mega Backdoor Roth” strategy.

Normally, Roth contributions are limited to about $7,000 per year. However, high earners use a two-step process:

- Contribute after-tax dollars to a 401(k).

- Immediately convert those funds to a Roth IRA.

This can allow up to $66,000 per year to be funneled into tax-free growth — effectively bypassing contribution limits. Over time, these accounts can grow into multi-million-dollar, tax-free portfolios.

9. Charitable Remainder Trusts (CRTs)

Charitable remainder trusts are a favorite among wealthy philanthropists — not only because they benefit charities but also because they provide major tax advantages.

Here’s how it works:

- You transfer appreciated assets (like stocks or real estate) into a CRT.

- You receive an immediate charitable deduction.

- The trust sells the asset without paying capital gains tax.

- You then receive lifetime income from the trust.

When you die, the remainder goes to charity — but during your lifetime, you’ve enjoyed tax deductions, steady income, and avoided capital gains.

It’s a legal, strategic blend of altruism and asset protection.

10. Private Foundations and Donor-Advised Funds

Private foundations are essentially family-run charitable organizations that provide tax deductions, income opportunities, and long-term wealth management.

When the ultra-rich “donate” money to their foundation, they:

- Get an immediate tax deduction.

- Retain control over how and when funds are distributed.

- Employ family members or advisors with foundation salaries.

Similarly, donor-advised funds (DAFs) let the wealthy deposit money, get a full tax deduction instantly, and distribute funds to charities later — sometimes years later.

This system creates an elegant loop: donate strategically, save on taxes today, and maintain influence tomorrow.

Political Power: How the Wealthy Shape the Tax Code

The Lobbying Industry’s Hidden Influence

The U.S. tax code is over 75,000 pages long — and much of it didn’t come from politicians, but from lobbyists and corporate lawyers.

According to OpenSecrets.org, financial and corporate lobbying on tax policy exceeded $550 million in 2024 alone. Large corporations and billionaires fund think tanks, policy institutes, and PACs that quietly shape tax legislation in their favor.

The Revolving Door Between Wall Street and Washington

Many lawmakers responsible for regulating tax policy later join private equity firms or investment banks with multi-million-dollar salaries.

This “revolving door” creates a feedback loop where tax policies are written to benefit the same institutions that fund political campaigns.

How Tax Policy Protects the Elite

When capital gains are taxed at half the rate of labor income, it sends a clear message:

“Owning wealth is rewarded; working for it is not.”

The system encourages asset accumulation, not effort — and the elite ensure it stays that way.

The Impact of Loopholes on Global Inequality

The Middle-Class Tax Trap

While the middle class pays taxes on every paycheck — income, Social Security, Medicare — the rich often pay taxes on nothing until they choose to sell.

The result? The average worker might face a 25–30% effective tax rate, while billionaires enjoy single digits.

Data: How the Top 1% Pay Less Than Ever

In 2025, a ProPublica analysis found that the top 25 richest Americans paid an effective tax rate of just 3.4%, compared to 14% for the middle class.

This is made possible through deferrals, write-offs, and borrowed income. Even as wealth compounds exponentially, their reported taxable income stays minimal.

The Global Consequences of Unequal Taxation

Globally, trillions of dollars are locked in offshore financial networks, depriving nations of tax revenue for infrastructure, education, and healthcare.

According to the IMF, over $12 trillion is currently held offshore — enough to eliminate extreme poverty multiple times over.

How AI, Crypto, and New Laws Are Changing the Tax Game

AI-Assisted Tax Optimization

In 2025, AI-powered tax engines are revolutionizing wealth management. Algorithms now scan global tax treaties, investment laws, and financial data to find automated tax optimization strategies in real-time.

For billionaires, this means instant identification of global arbitrage opportunities — where to hold assets, when to sell, and how to offset income with losses across jurisdictions.

The Rise of Crypto and Tokenized Wealth Shelters

Cryptocurrency isn’t just a speculative asset — it’s becoming a tool for private, borderless wealth management.

Through decentralized finance (DeFi) and tokenized real estate, investors can fractionalize ownership and shield income using blockchain structures outside traditional reporting systems.

However, new global regulations like FATF’s “Travel Rule” and U.S. crypto reporting requirements are slowly tightening the noose on anonymity.

International Crackdowns on Hidden Wealth

The OECD’s Global Minimum Tax and initiatives like CRS (Common Reporting Standard) are forcing greater transparency.

But history shows — every time a loophole closes, a new one opens. The wealthy will adapt faster than governments can legislate.

What You Can Learn from the Rich (Legally)

While many loopholes are reserved for the ultra-wealthy, the principles behind them can help anyone improve financial efficiency.

Building Your Own Tax Strategy

Instead of only focusing on earning more, focus on keeping more.

- Use retirement accounts (401(k), Roth IRA, SEP-IRA) for tax-deferred growth.

- Track deductions for business expenses, education, and home offices.

- Reinvest profits strategically to delay taxation.

How to Turn Income into Assets

Shift from trading time for money to owning appreciating assets — stocks, rental property, or a small business.

Income from assets is taxed differently (and more favorably) than income from wages.

Smart Investment Structures for Long-Term Wealth

Even small investors can use LLCs, trusts, and holding companies to organize income, protect assets, and manage taxes more effectively.

As the saying goes:

“The rich don’t work for money. They make money work for them — tax-free.”

Conclusion – Knowledge Is Your Greatest Asset

The rich aren’t just lucky — they’re strategic. They know how to use the system, not fight it. While politicians debate fairness and reform, the wealthy quietly restructure, reinvest, and relocate assets — always staying one move ahead.

But you don’t need millions to think like the rich. Start learning how the system works. Treat taxes not as a punishment but as a puzzle — one that rewards those who understand it.

In the modern economy, financial literacy is the new power — and those who master it can build freedom that no tax bill can take away.

Frequently Asked Questions (FAQs)

1. Are these tax loopholes legal?

Yes — every strategy listed is fully legal under current law. The wealthy don’t evade taxes; they use tax-advantaged structures that comply with the system.

2. Why doesn’t the government close these loopholes?

Many were intentionally created to encourage investment and economic growth. Closing them would face strong resistance from powerful financial and political interests.

3. Can average people use any of these loopholes?

Absolutely. Real estate depreciation, retirement accounts, and business deductions are examples anyone can use on a smaller scale.

4. Is borrowing against assets really tax-free?

Yes. Loans are not considered income, so as long as you don’t sell the asset, you owe no taxes.

5. Will AI make it easier to find new tax loopholes?

Yes — but also easier for regulators to detect abuse. AI will transform both sides of the tax equation.

6. How can I start learning tax-efficient investing?

Follow reputable sources like Investopedia, IRS.gov, and wealth management guides. A good financial advisor can help tailor strategies to your situation.

You must be logged in to post a comment.